AFC : Votre spécialiste des courtiers en paris sportifs

Parier sur le sport est devenu un passe-temps populaire pour de nombreuses personnes dans le monde. Et avec l’avènement des paris en ligne, il est devenu encore plus facile de parier sur son équipe ou son joueur préféré. Mais qu’est-ce qu’un courtier en paris sportifs ?

Un courtier en paris sportifs (ou betting broker) est un intermédiaire qui vous aide à placer votre pari auprès d’un bookmaker. Les courtiers travaillent généralement avec plusieurs bookmakers asiatiques et peuvent vous aider à trouver les meilleures cotes pour le match sur lequel vous souhaitez parier. Ils peuvent également vous aider sur d’autres aspects des paris sportifs, comme le choix d’une stratégie de pari ou la gestion de votre capital.

Si vous souhaitez placer un pari sur un match particulier, un courtier en paris asiatiques peut être une ressource précieuse. Il peut vous aider à trouver les meilleures cotes et s’assurer que vous tirez le meilleur parti de votre expérience en matière de paris sportifs.

Pourquoi utiliser un courtier en paris ?

Il y a de nombreuses raisons pour lesquelles vous pourriez vouloir faire appel à un courtier en paris. Un courtier en paris peut vous faire gagner du temps et de l’argent en trouvant les meilleures cotes pour vous. Il peut également vous conseiller sur les paris à effectuer et sur la façon de gérer votre argent. Les courtiers en paris sont des experts dans le domaine des jeux d’argent, ils peuvent donc vous aider à tirer le meilleur parti de votre argent.

Si vous envisagez de faire appel à un courtier en paris, il y a quelques points que vous devez garder à l’esprit. Premièrement, les courtiers en paris facturent généralement une commission pour leurs services. Cette commission correspond généralement à un pourcentage du montant de votre pari. Deuxièmement, vous ne devez faire appel à un courtier en paris que si vous voulez vraiment jouer. Les courtiers en paris peuvent vous donner de nombreux conseils, mais ils peuvent aussi vous prendre votre argent si vous n’êtes pas prudent.

- Un bet broker peut vous aider à placer des paris sur une variété d’événements sportifs différents.

- Un sport betting broker peut vous aider à gérer votre bankroll de paris.

- Un sport broker peut vous donner des conseils sur la meilleure façon d’utiliser votre argent.

- Un bet agent peut vous fournir des informations précieuses sur le monde des paris.

- Un courtier en paris sportifs peut vous aider à entrer en contact avec d’autres parieurs et à former un syndicat de parieurs.

Avantages :

- De meilleures cotes : les courtiers en paris ont souvent accès à de meilleures cotes que les bookmakers traditionnels. Cela est dû au fait qu’ils ne sont pas limités par les mêmes restrictions que les bookmakers traditionnels.

- Limites de paris plus élevées : Vous pouvez miser de grosses sommes d’argent sans limite.

- Un plus large éventail d’événements : Comme mentionné ci-dessus, les courtiers en paris couvrent un large éventail d’événements. Cela signifie que vous pouvez parier sur une grande variété de sports et d’événements.

- Risque réduit : Parier avec un courtier peut réduire le risque de perdre de l’argent. En effet, vous pouvez répartir vos paris sur un certain nombre d’événements différents et sur plusieurs bookmakers, ce qui réduit le risque de perdre toute votre mise sur un seul pari.

- Skype Betting : pour les gros parieurs, les courtiers permettent de prendre des paris directement sur Skype ou Telegram.

Inconvénients :

- Les courtiers en paris prennent une petite commission.

- Il se peut que vous ne receviez pas vos gains aussi rapidement que si vous aviez placé le pari vous-même.

- Les courtiers en paris peuvent ne pas être disponibles dans tous les pays.

Comment fonctionne un courtier en paris sportifs ?

Un courtier en paris est un intermédiaire qui met en relation les parieurs et les bookmakers. Les courtiers en paris permettent aux parieurs de placer des paris auprès de plusieurs bookmakers sans avoir à créer des comptes séparés avec chacun d’eux. Cela peut être bénéfique pour un certain nombre de raisons. Tout d’abord, il peut être difficile d’ouvrir un compte chez un bookmaker si vous vivez dans un pays où les jeux d’argent en ligne sont limités. Les courtiers en paris peuvent vous aider à contourner ces restrictions en plaçant votre pari pour vous. Les courtiers en paris peuvent également vous aider à obtenir de meilleures cotes sur vos paris. En faisant le tour de plusieurs bookmakers, un courtier en paris peut trouver les meilleures cotes pour votre pari et vous aider à en avoir pour votre argent.

Quels sont les meilleurs services de courtage de paris ?

A mon avis, après des années de pratique, voici ma sélection :

1. BetInAsia

Betinasia est un courtier en paris de premier plan qui offre un large éventail de services à ses clients. Il propose une plateforme simple et facile à utiliser qui rend les paris en ligne pratiques et amusants. Ils offrent également un large éventail de marchés, des cotes compétitives et un environnement sûr et sécurisé pour tous leurs clients.

Leur offre est divisée en deux parties :

- Un logiciel dédié (basé sur Mollybet) pour trouver les meilleures cotes en temps réel chez les meilleurs bookmakers asiatiques. Cette offre s’appelle BLACK.

- Accès au marché d’échange de paris betfair, avec des frais réduits. Cette offre s’appelle ORBIT EXCHANGE

BetInAsia est un partenaire très professionnel sur lequel vous pouvez compter. Il propose de nombreuses options de paiement et j’ai toujours pu effectuer des retraits. Le premier retrait du mois est gratuit.

Plus de détails sur l’offre de BetInAsia ici.

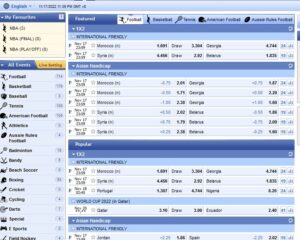

2. AsianConnect

AsianConnect est un courtier de confiance en paris en ligne et en sport asiatique qui offre un moyen sûr et sécurisé de placer des paris sur vos sports et jeux préférés. Il donne accès à un large éventail de sites de paris et de jeux en ligne, et notre équipe expérimentée est à votre disposition pour vous aider à trouver les meilleures cotes et les meilleurs prix. Ils offrent également une gamme de fonctionnalités et de services pour vous aider à tirer le meilleur parti de votre expérience de pari, y compris le streaming en direct, les paris in-play et les retraits.

Leur offre peut être résumée comme suit :

- Accès aux principaux bookmakers asiatiques en un seul endroit (y compris Pinnacle) et possibilité d’utiliser leur outil dédié ASIANODDS pour parier en temps réel à de meilleures cotes,

- Accès à ORBITX & PIWI pour l’échange de paris (le betting exchange).

AsianConnect est le plus ancien courtier encore en activité. On peut faire confiance à cet opérateur. J’ai toujours reçu mes paiements, mais les possibilités de retrait sont plus limitées que chez les autres courtiers.

Plus de détails sur l’offre AsianConnect ici.

3. SportMarket

SportMarker offre des cotes compétitives sur un large éventail de marchés de paris sportifs. Cela signifie que vous pouvez obtenir la meilleure valeur pour vos paris lorsque vous utilisez SportMarker. Enfin, le broker propose un large éventail de méthodes de paiement et de retrait, ce qui vous permet d’obtenir facilement vos gains.

Chez Sportmarket, ils offrent presque les mêmes services que les précédents, avec une plateforme de paris dédiée Sportmarket PRO basée sur Mollybet. Les moyens de paiement sont nombreux avec à aucun frais de dépôt et 1 retrait gratuit par mois. Mais cette offre est plus dédiée aux parieurs professionnels avec un dépôt minimum de 100€ et les commissions sur les bourses de paris sont un peu plus élevées que les autres. Mais ils donnent accès à Pinnacle, BetDAq, SBObet, betfair, BetISN, Matchbook, SingBet, Smarkerts…

Plus de détails sur l’offre SportMarket ici.

Le recours à un betting broker est-il coûteux ?

Les courtiers en paris sont des personnes qui gagnent une commission en organisant des paris entre des parieurs (personnes qui placent des paris) et des bookmakers (sociétés qui prennent des paris).

Le courtier en paris trouve quelqu’un qui souhaite placer un pari sur un certain résultat, puis trouve un bookmaker qui accepte de prendre ce pari. Le courtier en paris prend alors une partie des gains du pari comme commission.

Le recours à un courtier en paris est-il légal ?

Ces intermédiaires ne sont pas considérés comme des opérateurs de paris sportifs. Ils ne sont donc pas soumis aux lois locales sur les paris sportifs et ne nécessitent pas d’accord spécial. Mais ils possèdent tous une licence de paris à Curaçao.

D’un autre côté, comme vous, en tant que parieur, ne placez pas directement un pari (c’est le courtier qui le fait), vous n’êtes pas considéré comme un parieur, et donc pas soumis à la réglementation locale sur les paris sportifs.

Les dernières techniques que vous devez connaître :

- Le top 8 des meilleurs bookmakers asiatiques

- Comment réduire les frais de betfair exchange ?

- Comment gérer l’argent de vos paris en un seul endroit ?

- Quelles sont les solutions pour les paris sportifs en crypto-monnaies ?

- Telegram betting: accès à l’outil de pari pro

- Skype Betting : Est-ce seulement pour les gros parieurs ?